I can’t believe it was almost two years ago, but back in August 2013 I blogged about my ‘game plan’ for early retirement: “How I plan to win at the game of Yloponom”.

I was just reading it again, and I’m surprised at how I thought I had things all figured out. Little did I know of what was to come.

1. I said I’d have to stay at my current job until age 55 (to avoid a 10% penalty on early 401K withdrawals).

Well, that sure didn’t happen! I assumed I’d be working in 2016, never dreaming I’d leave my company almost 2 years earlier than planned. But I also learned something in the interim, regarding that “55 Rule”; the Federal gov’t doesn’t impose a 10% penalty on 401K withdrawals if you work to age 55, but that’s no guarantee your company will go along with your plan. I was counting on small withdrawals, once a year. My company couldn’t guarantee that, but they could offer (penalty-free, at age 55) a lump-sum payout. The tax bill would’ve been enormous.

2. Those annual 401K withdrawals were only to meet the minimum income requirements for Obamacare—I didn’t need to withdraw much, right? Wrong

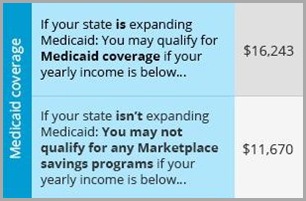

Since that earlier blog, Pennsylvania expanded their Medicaid program. What this means is, for someone like me who wants to buy health insurance, I now have to report a higher income ($5000 more than I anticipated) to qualify for Obamacare.

I’ll need to report a higher MAGI (Modified Adjusted Gross Income) of at least $16,243.00 on my 2015 taxes now

To play it safe, I gave Obamacare an income estimate of around $18,000 for 2015.

(Of course, that “minimum income required” is bound to go up every year too.)

3. Since I left my job before age 55, if I take money from my 401K I’m going to have to pay that 10% penalty, right? Not if I can help it

Here’s the thing: I DON’T NEED MY 401K TO LIVE ON (just yet). I only want to withdraw the least amount necessary (and pay taxes on it) to report taxable income. Here’s what I have to do before the end of the year:

- Open a Traditional IRA. (Done)

- Rollover my company’s 401K to that IRA. (Done)

- Open a Roth IRA. (Done)

- Move at least $13,000 from my Traditional IRA to the Roth; I can’t spend it for 5 years, but doing this lets me pay taxes on that 13K now—and report it on my 2015 income tax.

- Wait, don’t I need to report at least $16.243? Yes but my personal investments will earn about $3-4,000 in dividends for 2015.

4. That takes care of having affordable health insurance (hopefully until I’m eligible for Medicare); but what do I live on?

That’s where my personal investments come in. At the start of the New Year, I’m going to look at the balances of my investments, both personal and retirement, and withdraw 4-4.5% of the combined total from my personal portfolio to live on.

And frankly, that’s the part that worries me here more than anything. I know how much I need to live on. I’ll want that, and hopefully a few thousand more to blow at the racetrack (heh, just kidding). But if we were to have another stock market crash like in 2008, or even a large downturn anytime soon… things would get dicey.

The only thing I know for sure at this point is—I don’t want to go back to work anytime soon, and I aim to keep it that way.

Doug, if the market does nosedive you can always break out the thong and baby oil and hit the stage again

ReplyDeleteHaha! I'd better cut back on some on the pizza & ice cream then--thanks Andrew :)

Delete