It’s hard to believe, but in 3 months I’ll have finished my fourth year of this “early retirement” experiment. (Yep, I’m still calling it an experiment—too reliant on the stock market, too young to collect social security.) But recent health crisises aside, I feel I’ve been pretty lucky… well, in the finance dept at least.

My first year of retirement I didn’t even touch my investments. I lived solely from my checking & savings, and watched as things took a tumble in my stock portfolio. That was not a good sign!

But the market recovered, and I feel like I still have a good chance.

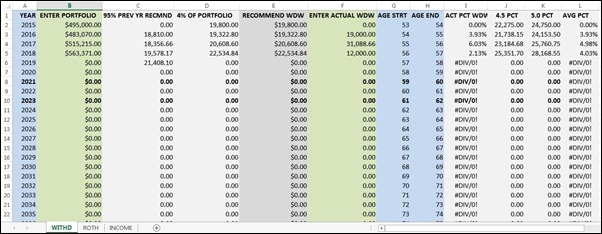

Back in July 2016, I set up a pretty rudimentary spreadsheet to track my withdrawals and wrote about it here: The bows & arrows of not so outrageous fortunes. It was based on my plan to “withdraw 4% of stocks every year or 95% of the previous year’s withdrawal, whichever was greater” and that’s still the idea, more or less.

(Since then, I’ve modified my portfolio to include all liquid assets.)

But I was still scribbling reminders, due dates & lots of numbers down on paper and needed to come up with something better. So I set up this “Retirement Manager”, a 3 tab excel file to keep me on track with spending, income and a Roth ladder (for parking IRA withdrawals penalty-free until I’m old enough to get my grubby hands on ‘em). So let’s take a look.

ApacheDug’s Retirement Manager

What is this? ANNUAL WITHDRAWALS FROM MY PORTFOLIO

When do I update it? Once a year, hopefully in January.

What do I update on it? My portfolio’s value (when I’m ready to make a withdrawal) in Col B, then my annual withdrawal in Col F.

Everything else is automatically calculated: after I enter the amount of my portfolio, Col C shows me 95% of last year’s “recommended withdrawal”, Col D calcs 4% of this year’s portfolio. Col E compares Cols C & D and gives me this year’s “Recommended Withdrawal Amount”.

Cols G-H show my age at the start of the year & end, Cols I-L calcs the percentage of my actual withdrawal, what the amount would be if I chose to withdraw 4.5 or 5% and a running percent average of my withdrawals to date. I really need to keep Col L under 4.5%!

Tab 2

What is this? INCOME

When do I update it? Every December, or I can update it quarterly when I get dividends from my taxable (non-retirement) investments.

What do I update on it? The profit/loss incurred from the sale of stocks (Col B), quarterly dividends from my taxable investments (Cols C-F), interest from savings (Col G), job earnings or IRA withdrawals (Col H).

Col I is a running subtotal for the year.

Col J shows the current Fed Poverty Level. Col K calculates 138% of said amount, and Col L reports the minimum amount I still need to convert from my IRA to my Roth to ‘up’ my MAGI & meet ACA’s minimum income rule. (I need a MAGI of at least 138% of the Federal Poverty Income to buy ACA Health Insurance.)

Col M is the actual amount I converted to Roth (if any)—and COL N reports the final total, my MAGI. Did ya get all that?

Tab 3

What is this? ROTH LADDER

When do I update it? The last week of December.

What do I update on it? The sale (transfer) of stocks from my IRA to my Roth (Col B). I do this to create taxable income without incurring early-withdrawal penalties for being below retirement age.

It MUST be equal or greater than the amount ahown for the same year in Col L from my INCOME table (Tab 2). It’s only to have the income required by Obamacare. Once I hit 59 1/2 years old, I can just withdraw from my IRA without doing these Roth conversions, or I can keep converting.

BTW, as long as I’m under 59.5, I have to pay Federal –and- state taxes on these converted anounts. But come 2021, just Federal. (There is no state tax on IRA withdrawals or Roth conversions for people 59.5 or older in Pennsylvania.) Woo-hoo!

The one negative about these conversions is, every time I do one, that year’s amount cannot be touched for 5 years.

(But the year you do it in counts as an entire year. My first conversion was Dec 23, 2015; I get to include 2015 in my 5 year count. 2015,16,17,18,19. I can withdraw that first years conversion in January 2020. 2016’s converted amount can be taken in January 2021, etc.)

The PLUS about having a Roth account is that any gains from investments aren’t taxed. For example, from 2015-17 I converted $31,000 to my Roth—but its current market value is $38,700. I’ll pay no taxes on those gains (provided they’re still there) when I choose to sell.

And there you have it, my Retirement Manager. Isn’t it swell? It does most of the work so I don’t have to. And it should, because I’m retired—I think!

No comments:

Post a Comment

Thanks for stopping by. I'm glad to hear from you and appreciate the time you take to comment.