Six months ago, I had a lot to think about; it had been one year since my final paycheck, and plans for the first withdrawal from my stock portfolio were on hold, due to the market’s historic nosedive right on New Years Day 2016. Luckily, I still had several months of living expenses in my checking account and was able to hold out awhile longer, hoping for some decent recovery in the stock market.

So I watched & waited, and when Wall Street looked a little rosier around the first of April, I took a closer look at my own finances:

- ***** in personal checking

- ***** in savings

- $445,000 in personal & retirement investments

When I left my job in December 2014, my stock portfolio was $447,000. (I hoped it would grow & be closer to 500K when I was ready to begin withdrawals.) Not only did it do zilch that first year, but on 1/1/2016 it was 435,000--12K lower. But that’s the breaks, so after holding out for 3 months my portfolio made some gains closer to that Dec 2014 balance and I prepared for my first sale of stocks.

I knew I’d need at least 21K to live on for one year & figured on earning about $4,500 in dividend & interest income in 2016. Would I be safe withdrawing 17K?

(This was a far cry from the amount I estimated paying myself a couple years ago, but the last year has shown me I need to take a much more conservative approach.)

When it comes to making annual withdrawals from your retirement portfolio, there’s so many trains of thought. I liked this one best:

Withdraw 4% of your portfolio’s balance every year or 95% of last year’s recommended withdrawal, whichever is greater.

I created an excel worksheet that crunches the numbers, all I have to do is enter the portfolio’s yearly balance in Col B, when I’m ready to make that annual withdrawal.

Col C will display 95% of the previous years withdrawal; Col D will calculate 4% of the portfolio’s current value. I’ll then enter in Col E the greater value of C or D.

So that’s what I did—sort of. According to my chart, I was ‘authorized’ to take $17,800 from my portfolio. But the preceding 15 months had been rocky and it just seemed like a lot to cash out, so I only withdrew 16K instead.

To be honest, I regretted taking even that; why did I cash that out in one sitting? Why not take 8K now & another 8K six months from now? Or 4K quarterly? That money could’ve stayed in the market vs. sitting in my checking account gathering dust. I wished I could put some of it back.

And then along came Brexit…

Last Friday when Great Britain rocked the world with their vote to leave the European Union and investors panicked the world over, I watched my own portfolio plunge in value & shrugged my shoulders—what can you do. I was good until 2017 anyway.

The following Monday as the bloodbath continued (the Dow had now sunk almost 1000 points) I visited a couple investor forums I frequent, and so-called retirement veterans were warning “get out of stocks, go all in cash, this could last a couple years”. I smelled temporary insanity.

It’s scary to buy when everyone is selling, but I hadn’t seen prices this low in a couple years so… the $16,000 I’d withdrawn from my portfolio… I put $5,000 of it back in.

Date Transaction Amount

06/27/2016 BUY 100.73 shares Total Stock Mrkt Idx Adm $49.64 per share $5,000.00

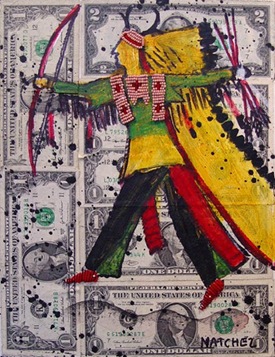

Those 100 shares I bought for $49.64 are now worth $55.00 each, and yes their price will go up & down & up again, but the important thing is, I was able to put some of that wampum back into the swim, and at a LOW PRICE.

Doesn’t this all sound like a major pain? Sometimes I think I’d sleep better if I’d just kept on working… or stuck my money in a safer place! The End!

No comments:

Post a Comment

Thanks for taking the time to comment, it really means a lot to hear from you.